Governor Hochul’s Credit Card Revolution: New Law Unveils Transparency for Consumers and Businesses!

Governor Kathy Hochul, in December 2023, signed a new consumer protection law set to take effect on February 11, 2024, amending and clarifying New York’s existing credit card surcharge law. This legislation aims to enhance transparency and safeguards for consumers. The law limits credit card surcharges to the amount charged to businesses by credit card companies. Businesses are now required to disclose the total price of an item or service, including the credit card surcharge, before checkout. Governor Hochul’s Credit Card Revolution: New Law Unveils Transparency for Consumers and Businesses!

To assist businesses in complying with the new law, the Department of State has developed a Credit Card Surcharge Guide and Video. The law also empowers local governments, along with the New York State Attorney General, to enforce credit card surcharge regulations. The New York State Division of Consumer Protection recommends that interested localities review the Division’s Credit Card Surcharge Legal Update Letter for additional information.

New York Secretary of State Robert J. Rodriguez emphasized the importance of consumers being aware of the total cost, inclusive of any surcharge, before reaching the register. State Senator Jeremy Cooney praised the legislation for promoting transparency in pricing, enabling consumers to make informed decisions. Assemblymember Amy Paulin expressed gratitude to Governor Hochul for signing the bill, emphasizing its role in protecting New Yorkers from hidden surcharges.

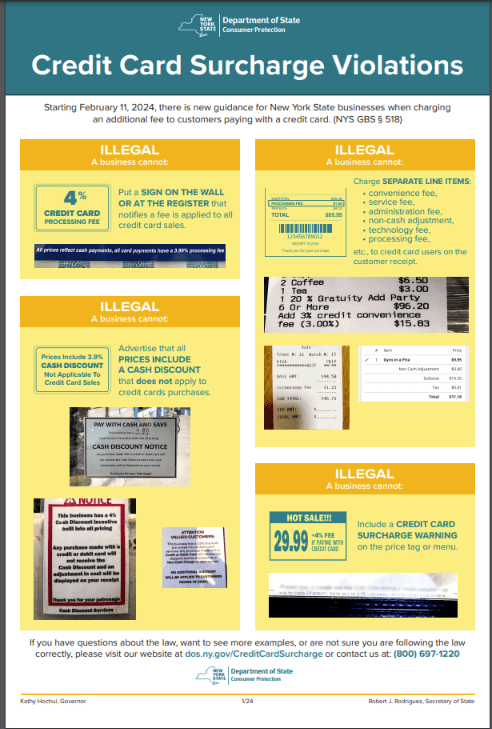

The law outlines acceptable and unacceptable practices regarding credit card surcharge notices. Examples of compliant practices include listing credit card prices alongside cash prices or offering discounts for cash payments. However, practices such as posting additional surcharge signs or displaying separate fees on customer receipts are discouraged. It’s essential to note that the law does not apply to debit cards.

After February 11, 2024, local governments can join in enforcing the law, providing additional resources for compliance and broader opportunities to promote consumer protections. The Division of Consumer Protection encourages consumers to file complaints if they encounter issues related to credit card pricing at the register. The law aims to prevent fraudulent practices and protect consumers while offering educational assistance to both consumers and businesses.

For more information and assistance, consumers can contact the New York State Division of Consumer Protection through the Consumer Assistance Helpline at 1-800-697-1220 or visit www.dos.ny.gov/consumer-protection. Additional consumer protection tips and alerts can be found on the DCP website or via social media on Twitter at @NYSConsumer and Facebook at facebook.com/nysconsumer.