File Your Taxes Safely and for Free

If you earn $62,000 or less, you may qualify for FREE TAX PREP services, including online filing and in-person filing with an IRS certified VITA/TCE volunteer preparer.

Before you file your taxes, see what documents you need.

| There are two ways to file your taxes safely and for free: | |

| In person at your local free tax preparation site Sites offering this service have varying income eligibility requirements. For most sites, you must earn $54,000 or less (with children) or $30,000 or less (no children).

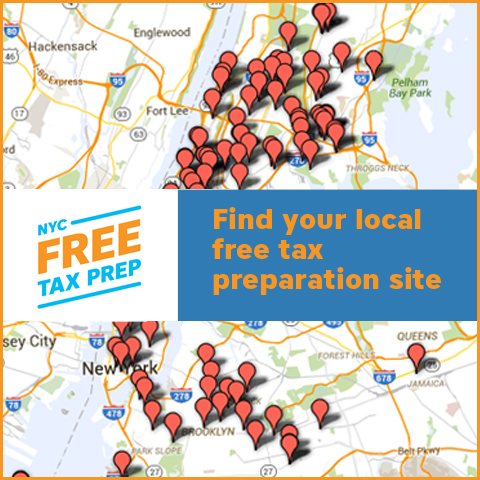

Find an NYC Free Tax Prep site near you using our interactive map. |

|

|

|

|

| Online Annual income $62,000 or less.

If you earn $31,000 or less, click here to file your taxes with Turbo Tax Freedom Edition. |

|

Additional Information

Do you know your rights when using a tax preparer? Learn more

IRS provides tax filers with many helpful resources. Learn more

Did you know you could save money with NYC’s Commuter Benefits Law? Learn more

Did you open a SaveUSA account in 2015? Learn more

Did you use an NYC Free Tax Prep site to file your taxes? Let us know on Twitter, Facebook, andInstagram using the hashtag #FreeTaxPrep.

Learn more about the City’s Annual Tax Time Campaign